Some Known Factual Statements About Amur Capital Management Corporation

Table of ContentsAmur Capital Management Corporation Fundamentals ExplainedAmur Capital Management Corporation - An OverviewExamine This Report about Amur Capital Management CorporationAmur Capital Management Corporation Fundamentals ExplainedIndicators on Amur Capital Management Corporation You Need To KnowA Biased View of Amur Capital Management Corporation

This makes actual estate a lucrative long-term financial investment. Real estate investing is not the only method to spend.

Amur Capital Management Corporation Things To Know Before You Get This

Savvy investors may be awarded in the type of admiration and rewards. Since 1945, the ordinary huge supply has actually returned close to 10 percent a year. Stocks really can function as a lasting financial savings lorry. That stated, stocks can simply as conveniently drop. They are by no indicates a certainty.

That said, genuine estate is the polar opposite pertaining to specific aspects. Internet profits in actual estate are reflective of your own activities.

Any cash got or lost is a straight result of what you do. Supplies and bonds, while frequently lumped with each other, are fundamentally different from each other. Unlike stocks, bonds are not agent of a stake in a firm. Because of this, the return on a bond is repaired and does not have the possibility to appreciate.

The 5-Second Trick For Amur Capital Management Corporation

The real advantage realty holds over bonds is the moment structure for holding the investments and the rate of return during that time. Bonds pay a set interest rate over the life of the financial investment, thus purchasing power with that interest goes down with rising cost of living in time (investing for beginners in canada). Rental residential property, on the other hand, can generate greater leas in periods of greater rising cost of living

It is as easy as that. There will constantly be a demand for the rare-earth element, as "Fifty percent of the world's populace relies on gold," according to Chris Hyzy, primary financial investment policeman at U.S. Trust fund, the exclusive riches management arm of Financial institution of America in New York. According to the Globe Gold Council, demand softened in 2014.

Rumored Buzz on Amur Capital Management Corporation

As a result, gold prices must come back down-to-earth. This need to bring in innovators looking to exploit on the ground level. Acknowledged as a reasonably safe product, gold has actually established itself as a car to boost financial investment returns. Some don't even take into consideration gold to be an investment at all, instead a hedge against rising cost of living.

Obviously, as secure as gold might be considered, it still fails to remain as attractive as property. Right here are a few reasons financiers choose genuine estate over gold: Unlike genuine estate, there is no financing and, as a result, no space to take advantage of for growth. Unlike realty, gold recommends no tax obligation benefits.

Some Known Factual Statements About Amur Capital Management Corporation

When the CD develops, you can collect the initial financial investment, along with some rate of interest. Real estate, on the various other hand, can appreciate.

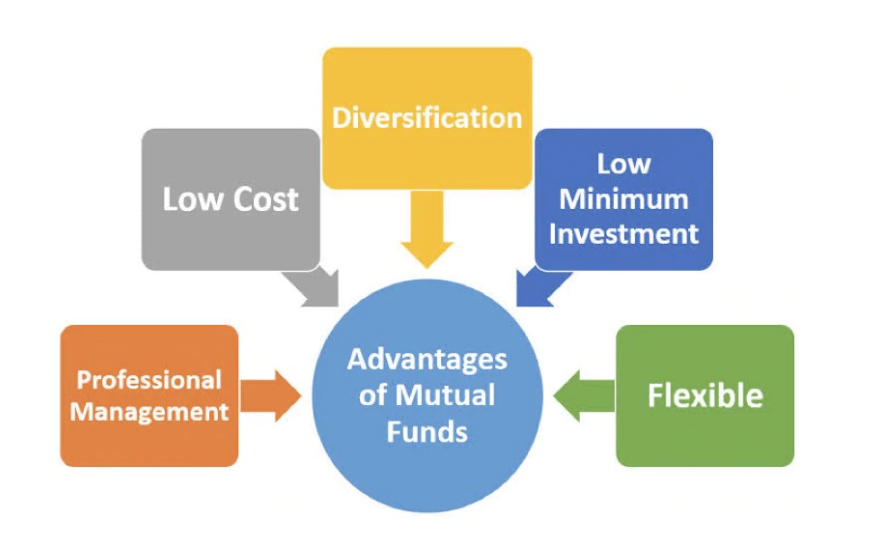

It is just one of the simplest methods to expand any profile. A mutual fund's performance is always gauged in regards to total return, or the amount of the modification in a fund's web property worth (NAV), its rewards, and its capital gains distributions over a provided amount of time. Much like supplies, you have little control over the efficiency of your assets.

Placing money into a mutual fund is basically handing one's financial investment choices over to a specialist money manager. While you can select and choose your investments, you have little state over exactly how they execute. The 3 most common means to buy realty are as adheres to: Acquire And Hold Rehabilitation Wholesale With the most awful component of the recession behind us, markets have been subjected to historical gratitude rates in the last three years.

What Does Amur Capital Management Corporation Mean?

Buying reduced doesn't suggest what it used to, and capitalists have actually acknowledged that the landscape is changing. The spreads that dealers and rehabbers have actually come to be familiar with are starting to invoke memories of 2006 when worths were historically high (exempt market dealer). Naturally, there are still many possibilities to be had in the globe of turning property, yet their explanation a new exit technique has become king: rental residential properties

Otherwise called buy and hold homes, these homes feed off today's appreciation rates and maximize the truth that homes are extra costly than they were simply a few short years earlier. The concept of a buy and hold departure strategy is basic: Investors will want to enhance their lower line by renting the property out and gathering month-to-month cash circulation or simply holding the home till it can be sold at a later date for an earnings, naturally.